The latest in-depth analysis released by HTF MI delves into the transformative impact of blockchain technology on the retail banking sector. The comprehensive report, extending beyond 120 pages, scrutinizes the strategies of major and rising entities within the industry, providing insights into current market progress, diverse landscapes, technological advances, and future growth catalysts. Prominent players such as Cognizant, Goldman Sachs, IBM, Microsoft, and others have been instrumental in driving this growth.

The breakthrough of blockchain in retail banking offers a vivid landscape of opportunities. Institutions like Banco Santander, Axoni, BitFury, and Digital Asset Holdings are at the forefront, exploring applications in areas like Middleware and Services as well as Infrastructure and Protocols. Predictive analytics point towards a resilient growth curve extending to 2030, with a detailed analysis available for stakeholders.

The geographical spread of the research touches on multiple key regions ranging from the Americas to Asia, each having their distinct market share and growth patterns. The report scrutinizes the resilience of the market in the face of global challenges, employing tools like Porter’s Five Forces and SWOT analyses for a robust assessment.

Emerging technological alliances, product launches, and strategic partnerships shape the dynamic progression of the retail banking blockchain market. Stakeholders looking to consolidate or expand their market position will find essential data points and forecasts within the report’s detailed tables and figures. Personalization options are available for those seeking tailored insights, accommodating up to three additional countries or companies.

With blockchain continuing to garner significant attention within the financial sector, the HTF MI report serves as a vital compass for understanding current trends and estimating future directions. As we proceed through 2023 and beyond, the interplay between blockchain and retail banking remains a pivotal area of development for industry professionals and investors alike.

Blockchain in Retail Banking: Opportunities, Challenges, and Insights

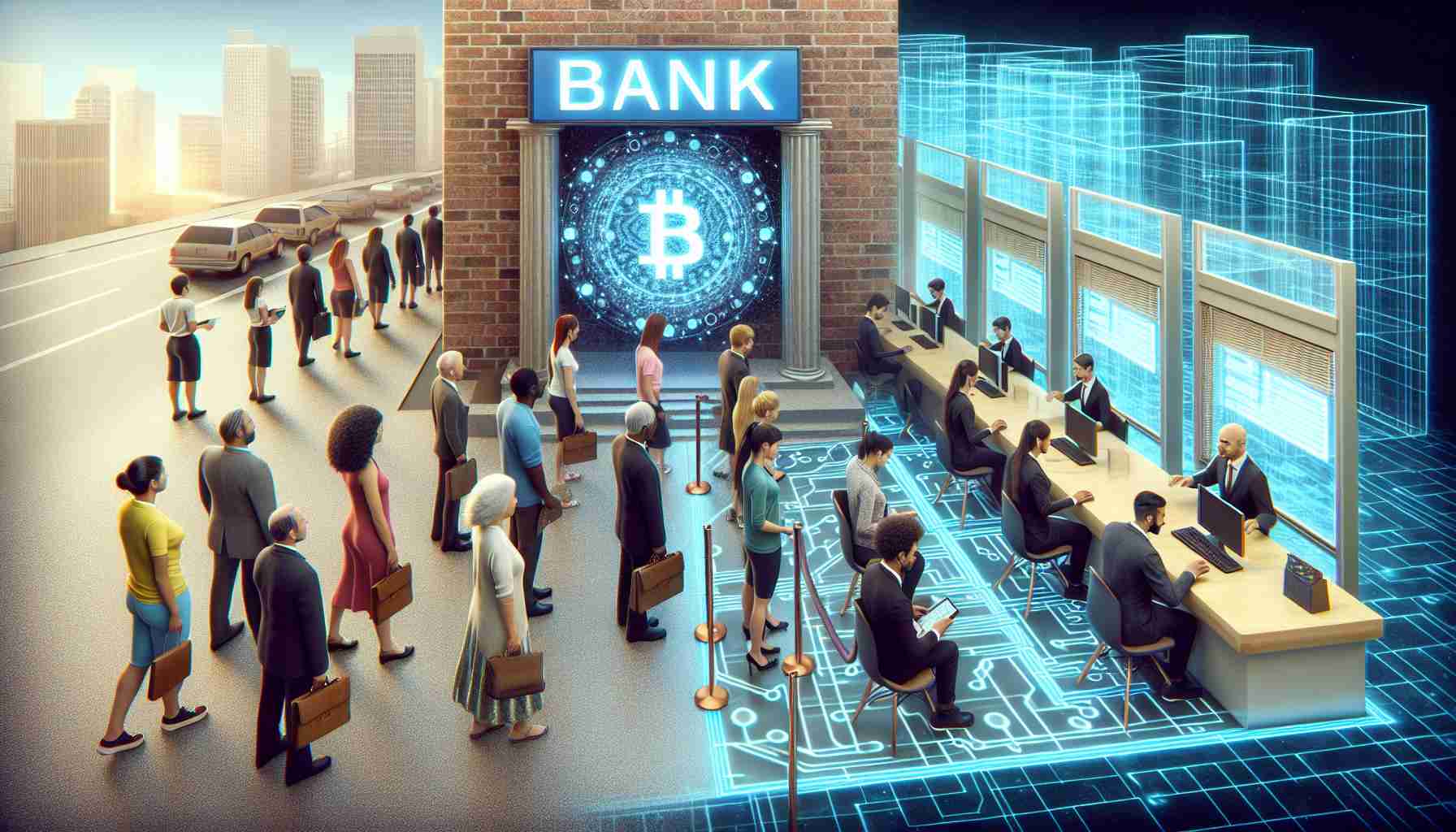

Blockchain technology is increasingly recognized as a disruptive force in the retail banking industry. Its capacity to offer secure and immutable ledger systems has potential applications in improving the efficiency and transparency of financial services.

One of the most pivotal areas where blockchain is generating a significant impact is in reducing fraud and enhancing security. For instance, the decentralized and tamper-evident nature of blockchain can help mitigate issues related to fraudulent transactions and identity theft.

Key Challenges and Controversies:

However, the integration of blockchain into retail banking is not without challenges. Here are a few key issues:

– Scalability: Blockchain networks need to handle large volumes of transactions rapidly to be viable in retail banking contexts.

– Regulation: The regulatory landscape for blockchain is still evolving, which can create uncertainties for banks and financial institutions looking to adopt this technology.

– Integration: Incorporating blockchain technology with existing banking systems can be complex and costly.

– Interoperability: Different blockchain systems need to work together seamlessly for widespread adoption, which is currently a major hurdle.

Advantages of Blockchain in Retail Banking:

– Security: Enhanced security features reduce the risk of cyber-attacks and fraud.

– Efficiency: Blockchain can streamline operations, reducing the time and cost of transaction processing.

– Transparency: Allows for greater transparency in transactions, which can build trust with consumers.

– Smart Contracts: The use of smart contracts can automate and enforce terms of service or agreements without the need for intermediaries.

Disadvantages of Blockchain in Retail Banking:

– Complexity: Blockchain technologies can be complex and may require significant expertise to implement and manage.

– Energy Consumption: Some blockchain systems, like those using proof-of-work, are criticized for their high energy consumption.

– Cultural Resistance: There may be resistance to change within institutions that have longstanding traditional processes.

Despite these challenges, the benefits of blockchain in retail banking are driving forward its adoption. Stakeholders in the banking sector, including technology providers, regulators, and financial institutions themselves, continue to explore new ways to address the challenges.

For further credible information on blockchain technology, one might explore authoritative websites like:

– IBM Blockchain

– Microsoft Blockchain

– Goldman Sachs

– Cognizant

These platforms provide resources, research, and insights into the use of blockchain across various industries, including banking. It is essential to ensure that the URLs provided are correct and valid, pointing to the domain without leading to specific subpages or promotional content.