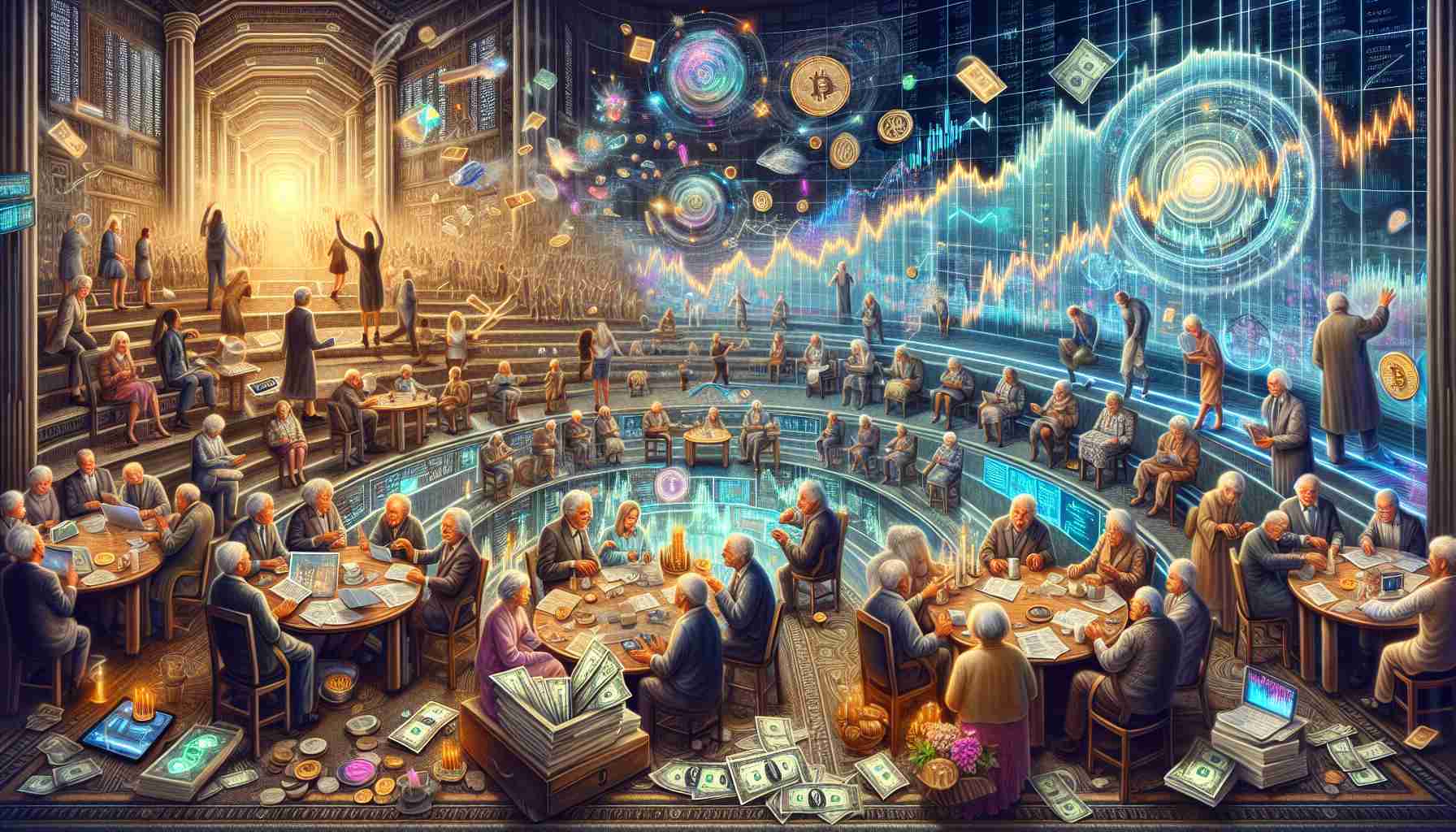

Younger Affluents Favor Real Estate and Cryptocurrency

A recent study from Bank of America discloses a stark disparity in investment inclinations among affluent individuals, categorized by age. The younger set, between 21-43 years old, is tilted towards real estate and cryptocurrency, demonstrating a waning confidence in conventional U.S. stock markets. An emphatic 72% of this group predicts that traditional stocks and bonds are incapable of delivering above-average gains.

Their appraisal of cryptocurrency appears linked to the success stories they’ve witnessed within their own generation, highlighting a clear generational shift in perception toward investment assets. Furthermore, an unexpected interest in collectible items like antiques has emerged, although this sector is fraught with risk and historically known for underwhelming financial performance.

Art Collection: A Cross-Generational Trend

Despite generational differences, an enthusiasm for acquiring artworks unites wealthy Americans. A robust 83% of the younger cohort either already possess an art collection or aspire to cultivate one. This demonstrates a shared belief in the potential of art investments, which have lately experienced a continuous bull market surge.

Young Investors Adopt an Optimistic Outlook

When considering economic prospects, young investors maintain a more optimistic viewpoint on both U.S. and global scales compared to their older counterparts, who share a similar stance on personal financial security. This divergence may reflect a traditional gap between generations’ outlooks or be influenced by varied media consumption habits.

As financial forecasts expect an enormous $84 trillion wealth transfer by 2045, experts anticipate this could boost markets favored by the youth, such as cryptocurrency and collectibles, depending on whether these preferences endure as the younger investors age.

Generational Wealth Transfer and Market Impact

A significant issue related to the generational divide in wealthy investors’ preferences is the forthcoming generational wealth transfer, expected to see Baby Boomers passing down an estimated $84 trillion to their heirs over the next few decades. This massive redistribution of wealth, primarily to Millennials and Gen Zers, could dramatically reshape investment landscapes. One of the key questions is whether the younger generation will maintain their current investment preferences as they age and their financial situations evolve.

Key Challenges and Controversies Associated with Generational Investment Preferences

One of the primary challenges is understanding the impact of these differing preferences on the financial markets. There’s controversy over whether the younger generations’ attraction to higher-risk investments like cryptocurrency is sustainable and whether these investors will pivot back to more traditional assets as they grow older and potentially become more risk-averse.

Another challenge is in the financial advisory space, where traditional wealth management firms may struggle to adapt to the preferences of a younger clientele who are digital-native, value different types of assets, and are possibly more globally minded in their investment approach.

The Influence of Technology and Digital Information

Technology’s influence is also a key factor. Younger affluent investors are often tech-savvy and have had exposure to a broad range of digital platforms that facilitate alternative investments such as cryptocurrencies and online real estate platforms. This has democratized access to certain asset classes that were previously less accessible to retail investors.

Advantages and Disadvantages of Younger Investors’ Preferences

Advantages:

– Diversification: Investments in cryptocurrency and real estate may offer diversification away from traditional stocks and bonds.

– Higher Potential Returns: Cryptocurrency, in particular, has the potential for high returns, albeit with higher risk.

– Technological Edge: The younger generation’s comfort with technology provides them with more tools and platforms for making informed investment decisions.

Dispartages:

– Increased Risk: Cryptocurrency is known for its volatility. Real estate can also bring significant financial risks, especially in unstable markets.

– Lack of Experience: Younger investors may be more susceptible to market hype or the novelty of certain investments without fully understanding the risk.

– Regulatory Concerns: Cryptocurrency markets are less regulated than traditional securities markets, raising concerns about security, fraud, and market manipulation.

For those interested in learning more about investments and the economy, you might want to visit reputable financial news sources like Bloomberg, Financial Times, or The Wall Street Journal. These platforms provide up-to-date information on market trends which may help in understanding the shift in investment preferences across generations.

Understanding these dynamics is essential, not only for individual investors but also for financial advisors, market analysts, and policy makers. The way these groups navigate and adapt to these preferences will have a significant influence on the future of investment strategies and the stability of global financial markets.